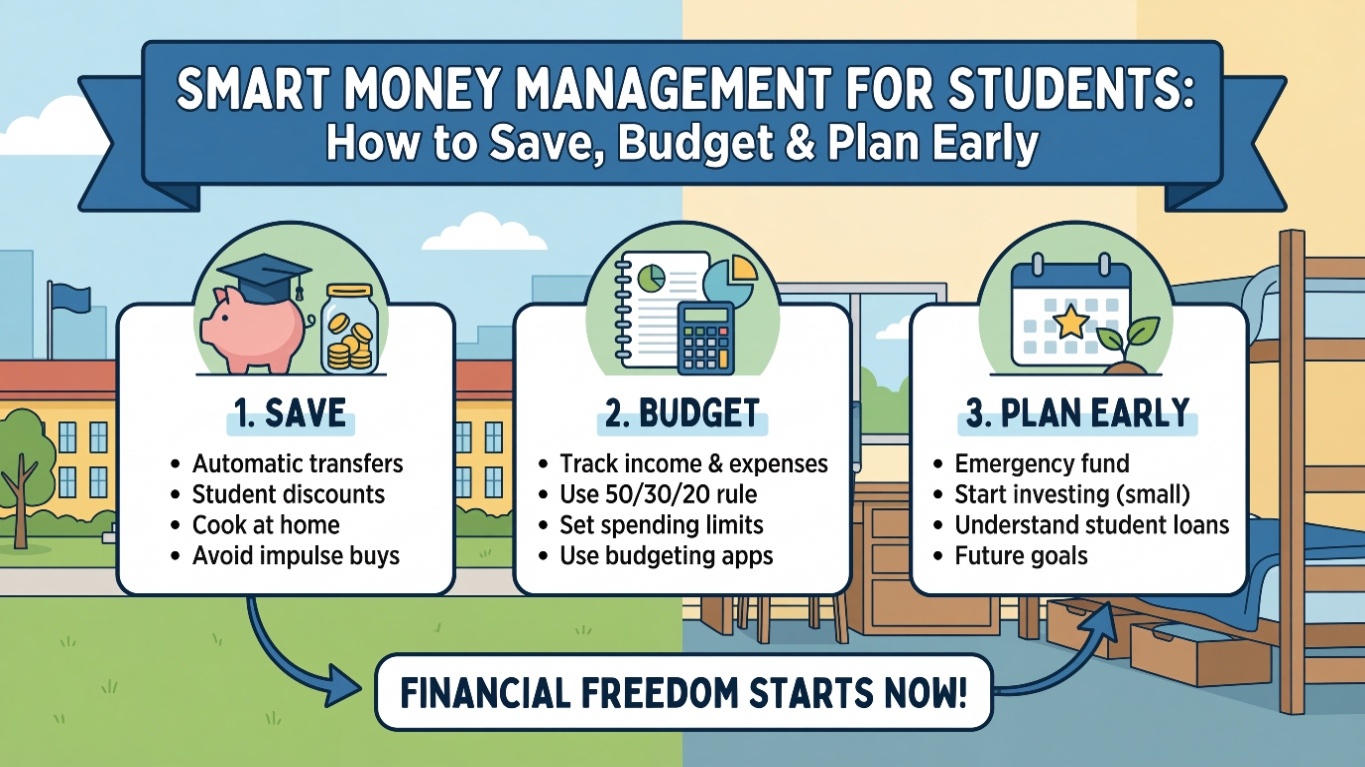

Hey there, fellow student! Juggling classes, assignments, and a social life is tough enough—add money worries on top, and it feels overwhelming. But here's the good news: starting smart money habits now sets you up for life. This guide breaks it down simply: save like a pro, budget without the stress, and plan for your future. No fancy jargon, just real tips that work.

Most students live on a tight budget from loans, part-time gigs, or family support. Without a plan, that cash vanishes on coffee runs and impulse buys.

Smart management means more freedom—think guilt-free hangouts or that dream laptop. Plus, early habits build wealth: compound interest turns small savings into big bucks over time. Start today, thank yourself later.

Budgeting isn't about restriction; it's your money roadmap. Track income (scholarships, jobs) and expenses to see where cash goes.

List everything for a week: apps like Mint or a free Google Sheet work great. You'll spot leaks, like $5$5 daily lattes adding up to $150$150 a month.

Adjust for student life: if rent's high, cut wants first.

| Category | Percentage | Example Monthly (on $1,000 income) |

|---|---|---|

| Needs | 50% | $500 (food, bills) |

| Wants | 30% | $300 (eating out, apps) |

| Savings | 20% | $200 (bank + fun fund) |

Saving feels boring until you see it grow. Aim for 3-6 months' expenses in an emergency fund first.

Set up auto-transfers to a high-yield savings account (like Ally or Capital One—rates over 4% as of 2025). Out of sight, out of mind.

Pro tip: Use the "jar method"—divide cash into jars (or apps) for rent, fun, and savings.

Don't wait for graduation. Early planning crushes debt and builds assets.

Pay minimums on time, then attack high-interest loans first (avalanche method). Refinance if rates drop—check Credible for options.

Start with a Roth IRA or index funds via apps like Robinhood or Vanguard. Put in $50/month; at 7% average return, it grows to $100,000+$100,000+ by 65.

Example: $100/month from age 20 at 7% = over $200,000 by 60. Magic of compounding!

Track wins monthly—what saved you the most?

Small steps lead to financial freedom. You've got this!

What’s your biggest money challenge right now—budgeting, saving, or debt? Drop a comment, and let’s chat tips!